On February 11, Energy Transfer reported its financial results for the fourth quarter and year ended 2024 with an earnings call hosted by co-CEOs Tom Long and Mackie McCrea.

This was another strong quarter for Energy Transfer, with robust growth in adjusted EBITDA compared to Q4 2023. We also saw strong performance in crude oil transportation volumes (up 15%), NGL transportation volumes (up 5%), NGL exports (up 2%), midstream gathered volumes (up 2%) and interstate natural gas transportation volumes (up 2%).

In addition to financial highlights, Long and McCrea provided details on Energy Transfer’s efforts to supply natural gas to data centers, power plants and manufacturing facilities, including the recently announced agreement with CloudBurst to provide natural gas to its flagship AI-focused data center in Central Texas.

(On the call, management referred to adjusted EBITDA and Distributable Cash Flow (DCF), both of which are non-GAAP financial measures. Reconciliations back to the comparable GAAP measures can be found here.)

“The level of activity from demand-pull customers has remained strong, and we’re in advanced discussions with several other facilities in close proximity to our footprint to supply, store and transport natural gas for natural gas power plants, data centers and industrial and onshore manufacturing. Given Energy Transfer’s extensive natural gas infrastructure, we continue to believe that we are the best positioned to capitalize on the anticipated rise in natural gas demand.” – Tom Long, co-CEO, Energy Transfer

“We’re learning a lot about data centers. Data centers are learning a lot about the natural gas business and how critical it is to what they’re doing. And we couldn’t be more pleased and excited about this new business because there’s no company in the United States that is close to as well-positioned to provide natural gas supply to many of these data centers especially in Texas, Oklahoma and Louisiana.” – Mackie McCrea, co-CEO, Energy Transfer

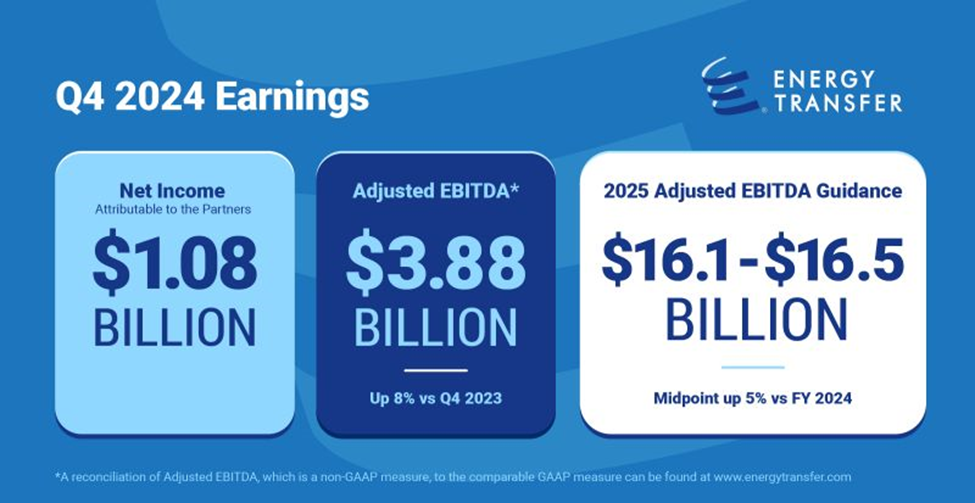

Full Year and Q4 2024 Financial Highlights*

More highlights from the earnings call are below. A webcast replay can be found here, and a more thorough discussion of the results in the Q4 earnings press release can be found here.

For full year 2024:

- Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) was $15.5 billion. This was up 13% over 2023 and was a partnership record.

- Distributable Cash Flow (DCF) attributable to the partners of Energy Transfer as adjusted was $8.4 billion, which was up 10% over 2023 and was also a partnership record.

- Operationally, we moved record volumes across our interstate, midstream, NGL and crude segments for the year ended 2024.

- We exported a record amount of total NGLs out of our Nederland and Marcus Hook terminals in 2024.

- We spent approximately $3 billion on organic growth capital excluding Sunoco (NYSE: SUN) and USA Compression Partners (NYSE: USAC). These investments were primarily in the midstream NGL and refined products segments.

For fourth quarter 2024:

- We generated adjusted EBITDA of $3.9 billion compared to $3.6 billion for the fourth quarter of 2023.

- DCF attributable to the partners of Energy Transfer as adjusted was $2 billion, consistent with the fourth quarter of 2023.

Fourth Quarter 2024 Highlights by Segment

- NGL and Refined Products. Adjusted EBITDA was $1.1 billion compared to $1.04 billion for the fourth quarter of 2023. This was primarily due to higher throughput and higher rates across our Gulf Coast and Mariner East pipeline operations and we also had strong NGL exports and increased profits from the optimization of hedged NGL inventory.

- Midstream. Adjusted EBITDA was $705 million compared to $674 million for the fourth quarter of 2023. The increase was primarily due to higher volumes in the Permian Basin, which was related to a 9% increase in legacy Permian throughput, as well as the addition of the Crestwood and WTG assets in November of 2023 and July of 2024, respectively. This was partially offset by decreased volumes in dry gas regions as a result of low natural gas pricing and increased operating expenses from recent acquisitions.

- Crude Oil. Adjusted EBITDA was $760 million compared to $775 million for the fourth quarter of 2023. During the quarter, we saw growth across our crude gathering systems, as well as contributions related to the recently formed Permian joint venture with SUN and the acquisition of Crestwood. These were offset by lower transportation revenues, primarily on the Bakken pipeline and reduced earnings from marketing.

- Interstate Natural Gas. Adjusted EBITDA was $493 million compared to $541 million for the fourth quarter of 2023. During the quarter, we saw higher demand on Panhandle, Trunkline, Gulf Run and FGT. This was offset by lower interruptible utilization, reduced rates on Panhandle and increased operating expenses.

- Intrastate Natural Gas. Adjusted EBITDA was $263 million compared to $242 million in the fourth quarter of 2023. The increase was primarily due to increased gains related to pipeline and storage optimization opportunities.

Project Highlights

- In December 2024, Energy Transfer announced a positive FID (final investment decision) for the construction of the Hugh Brinson Pipeline, which will provide significant, incremental transportation capacity out of the Permian Basin to connect shippers to Energy Transfer’s vast intrastate natural gas pipeline network and other downstream pipelines, as well as access to the majority of gas utilities in every major trading hub in Texas.

- Also in December 2024, we completed the initial phase of the Sabina 2 pipeline conversion from Mont Belvieu to Nederland, which increased the capacity for multiple products from 25,000 barrels per day to 40,000 barrels per day.

- In November 2024, we completed the optimization of the Grey Wolf processing plant in the Permian Basin, which increased the capacity of the plant from 200 MMcf/d to 250 MMcf/d.

- Energy Transfer recently commissioned the first of eight, 10-megawatt natural gas-fired electric generation facilities to support the Partnership’s operations in Texas. In February of 2025, Energy Transfer recently entered into a long-term agreement with CloudBurst Data Centers to provide natural gas to their flagship, AI-focused data center development in Central Texas. This project represents our first commercial arrangement to supply natural gas directly to a data center site. CloudBurst’s project remains contingent upon reaching a positive FID with its customer.

- • As it relates to other power generation opportunities, we have received requests for potential connections to approximately 62 power plants that we do not currently serve in 13 states and up to 15 plants that we already serve today. We have also received requests from over 70 prospective data centers in 12 states.

Forward-Looking Statements

This post may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including factors that may impact Energy Transfer’s operations, capital projects and future growth, are discussed in its Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. Energy Transfer undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.