On November 6, Energy Transfer reported its financial results for the third quarter of 2024 with an earnings call hosted by co-CEOs Tom Long and Mackie McCrea, and CFO Dylan Bramhall.

This was another strong quarter for Energy Transfer, with robust growth in adjusted EBITDA over Q3 2023. We also saw record performance in crude oil transportation volumes (up 25%), midstream gathered volumes (up 6%), NGLs produced (up 26%), and NGL fractionation volumes (up 12%) and transportation volumes (up 4%).

“We remain excited about our business and the demand for our products and services, both domestically and internationally, and we are uniquely positioned to help meet this demand for years to come.” – Mackie McCrea, co-CEO, Energy Transfer

“We have seen a wide range of estimates for new power demand, and the broad consensus suggest that natural gas fueled power demand will increase significantly in the future. We are already seeing increasing power needs across several of our natural gas pipelines driven by AI, data center and power plant growth. Given our extensive natural gas pipeline network, particularly in Texas and Oklahoma, we believe that Energy Transfer is one of the best positioned companies in the industry to help meet this demand.” – Tom Long, co-CEO, Energy Transfer

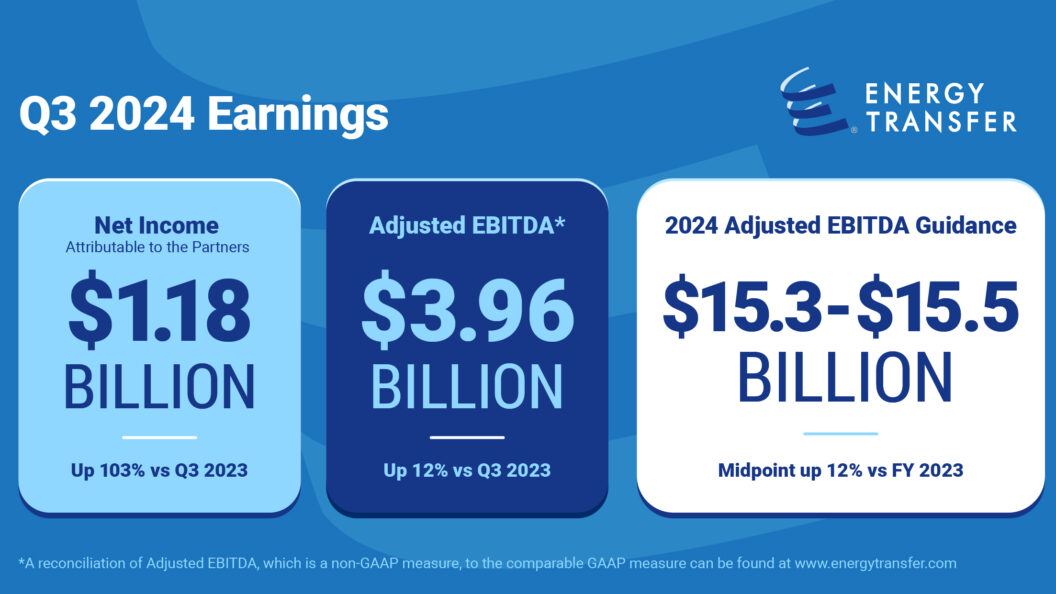

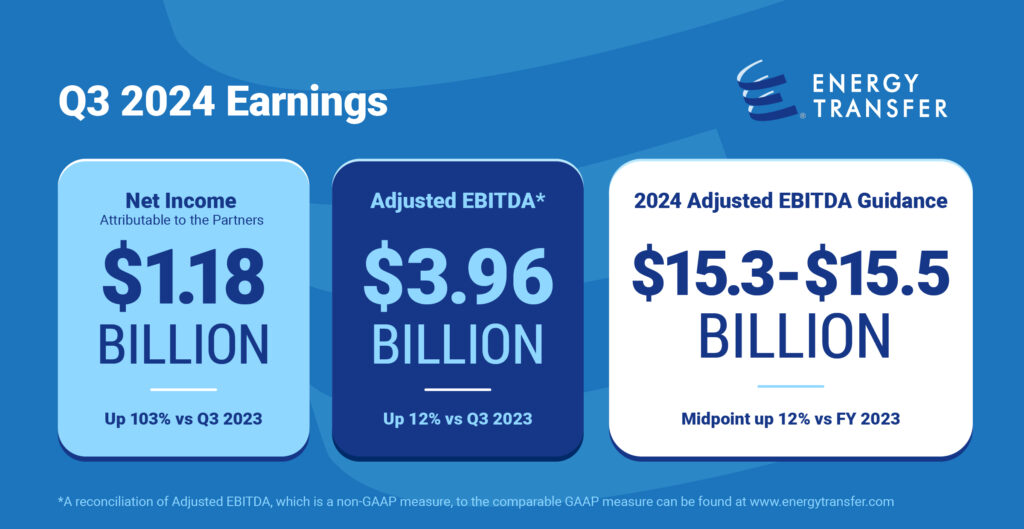

Q3 2024 Financial Highlights*

More highlights from the earnings call are below. A webcast replay can be found here, and the Q3 earnings press release can be found here.

- Energy Transfer reported net income of $1.18 billion compared to $584 million for the third quarter of last year.

- Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) was $3.96 billion compared to $3.54 billion for the third quarter of last year.

- Energy Transfer had record volumes through our crude oil midstream gathering and NGL pipelines, as well as through our NGL fractionators.

- Energy Transfer saw strong crude and NGL exports during the quarter, and increased volumes through our refined products pipelines.

- Distributable Cash Flow (DCF) attributable to the partners of Energy Transfer as adjusted was $1.99 billion, consistent with the third quarter of last year.

- For the first nine months of 2024, we spent approximately $1.7 billion on organic growth capital, primarily in the midstream and NGL and refined products segments excluding Sunoco LP (NYSE: SUN) and USA Compression Partners, LP (NYSE: USAC).

Highlights by Segment

- NGL and Refined Products. Adjusted EBITDA was $1.01 billion compared to $1.08 billion for the third quarter of 2023. This was primarily due to growth across our Mariner East pipeline operations as well as strong NGL exports, which were offset by lower gains from the optimization of hedged NGL inventory, as we recognized over $100 million in gains in the third quarter of last year compared to $30 million this year.

- Midstream. Adjusted EBITDA was $816 million compared to $631 million for the third quarter of 2023. The increase was primarily due to higher volumes in the Permian Basin and Eagle Ford as well as the addition of the Crestwood and WTG assets in November 2023 and July 2024, respectively.

- Crude Oil. Adjusted EBITDA was $768 million compared to $706 million for the third quarter of 2023. The increase was primarily due to record crude oil transportation throughput, higher crude oil exports, which were up 49%, the recently formed Permian joint venture with SUN as well as the acquisition of the Crestwood and WTG assets.

- Interstate Natural Gas. Adjusted EBITDA was $460 million compared to $491 million for the third quarter of 2023. During the quarter, we saw higher demand on PEPL, Trunkline and Gulf Run. This was offset by lower IT utilization in dry gas areas due to the lower gas prices and weaker spreads.

- Intrastate Natural Gas. Adjusted EBITDA was $329 million compared to $244 million in the third quarter of last year. The increase was primarily due to increased gains related to pipeline optimization opportunities.

Strategic Highlights

- In July 2024, Energy Transfer completed the acquisition of WTG Midstream Holdings LLC. Integration of the combined assets is underway, and we have recently approved several projects that are expected to enhance reliability, reduce losses and improve the overall efficiencies of the system for our customers.

- Also in July, Energy Transfer and Sunoco LP announced the formation of a joint venture combining their respective crude oil and produced water gathering assets in the Permian Basin. We are making good progress on integrating the combined systems and are executing on synergy and growth opportunities that will drive additional value while expanding our market and service offerings for our customers.

- With forecasts suggesting that natural gas fueled power demand will increase significantly in the future, Energy Transfer is seeing increasing opportunities to provide natural gas to power plants and data centers spread across its natural gas footprint, from Arizona to Florida and from Texas to Michigan.

* Reconciliations of Adjusted EBITDA and Distributable Cash flow, which are both non-GAAP measures, back to the comparable GAAP measures can be found at www.energytransfer.com