On May 6, Energy Transfer reported its financial results for the first quarter 2025 with an earnings call hosted by co-CEOs Tom Long and Mackie McCrea.

This was another good quarter for Energy Transfer, with adjusted EBITDA growing 6% over Q1 2024. We also saw strong performance in interstate natural gas transportation volumes (up 3% – a new Partnership record), crude oil transportation volumes (up 10%), NGL transportation volumes (up 4%), NGL and refined products terminal volumes (up 4%), NGL exports (up 5%) and midstream gathered volumes (up more than 2%).

“Given Energy Transfer’s extensive natural gas infrastructure, we are excited to see the growing demand in and around our franchise to support power plant, data center and LNG growth. With our diverse, integrated asset base and strong financial position, we believe we are well positioned to manage volatility while we continue to grow.” – Tom Long, co-CEO, Energy Transfer

More highlights from the earnings call are below. A webcast replay can be found here, and the Q1 earnings press release can be found here.

(On the call, management referred to adjusted EBITDA and Distributable Cash Flow (DCF), both of which are non-GAAP financial measures. Reconciliations back to the comparable GAAP measures can be found here.)

“As far as data centers, we call it the gold rush. We’re in such a good situation, very excited about it. There are 150 approximate data centers that we’re looking at just in Texas alone. We do believe in the next four to six weeks, we’ll be able to make some significant announcements.” – Mackie McCrea, co-CEO, Energy Transfer

Q1 2025 Financial Highlights

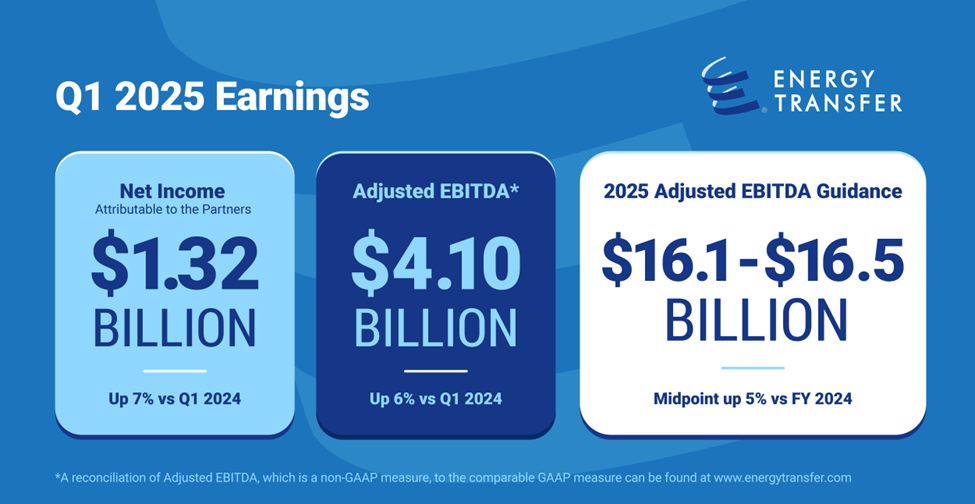

- Energy Transfer reported net income of $1.32 billion, up 7% compared to the first quarter of last year.

- Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) was $4.10 billion, up 6% compared to the first quarter of last year.

- We saw strong volumes through our midstream gathering, crude gathering, natural gas interstate and NGL pipelines, as well as through our NGL fractionators.

- We also saw strong NGL exports during the quarter.

- Distributable Cash Flow (DCF) attributable to the partners of Energy Transfer as adjusted was $2.3 billion, consistent with the first quarter of last year.

- For the first three months of 2025, we spent approximately $955 million on organic growth capital, primarily in the interstate, midstream and NGL & refined products segments (excluding Sunoco LP (NYSE: SUN) and USA Compression Partners, LP (NYSE: USAC).

Operational Highlights

- In February 2025, Energy Transfer commissioned the first of eight, 10-megawatt natural gas-fired electric generation facilities to support the Partnership’s operations in Texas. The second facility is expected to be in service in the second quarter of this year.

- During the first quarter of 2025, Energy Transfer commenced construction of Phase I of the Hugh Brinson Pipeline and secured all pipeline steel, which is currently being rolled in U.S. pipe mills.

Strategic Highlights

- In April 2025, Energy Transfer entered into a Heads of Agreement (HOA) with MidOcean Energy for the joint development of the Lake Charles LNG project, under which MidOcean would commit to fund 30% of the construction costs and be entitled to receive 30% of the LNG production.

- In April, Lake Charles LNG signed a binding SPA with a Japanese utility company for up to 1.0 million tonnes per annum (mtpa), with the agreement subject to the approval of the board of this company which is expected to be received by the end of May.

- Also in April, Lake Charles LNG signed an HOA with a German energy company for 1.0 mtpa.

- In February 2025, Energy Transfer entered into a long-term agreement with Cloudburst Data Centers, Inc. to provide natural gas to CloudBurst’s flagship AI-focused data center development.

- In February 2025, Energy Transfer approved construction of an additional natural gas processing plant in the Midland Basin. The Mustang Draw plant will have a processing capacity of approximately 275 MMcf/d and is expected to be in service in the second quarter of 2026.

Highlights by Segment

- NGL and Refined Products. Adjusted EBITDA was $978 million, compared to $989 million for the first quarter of 2024.

- Midstream. Adjusted EBITDA was $925 million, compared to $696 million for the first quarter of 2024.

- Crude Oil. Adjusted EBITDA was $742 million, compared to $848 million for the first quarter of 2024.

- Interstate Natural Gas. Adjusted EBITDA was $512 million, compared to $483 million for the first quarter of 2024. During the quarter, we achieved record interstate volumes, driven by higher throughput on Panhandle, Gulf Run and Trunkline.

- Intrastate Natural Gas. Adjusted EBITDA was $344 million, compared to $438 million in the first quarter of 2024.

Forward-Looking Statements

This post may include certain statements concerning expectations for the future that are forward-looking statements as defined by federal law. Such forward-looking statements are subject to a variety of known and unknown risks, uncertainties, and other factors that are difficult to predict and many of which are beyond management’s control. An extensive list of factors that can affect future results, including factors that may impact Energy Transfer’s operations, capital projects and future growth, are discussed in its Annual Report on Form 10-K and other documents filed from time to time with the Securities and Exchange Commission. Energy Transfer undertakes no obligation to update or revise any forward-looking statement to reflect new information or events.